The 2025/26 tax year ends on 5 April 2026. Once the clock strikes midnight on that day, several tax-efficient allowances and exemptions will reset – meaning that, in some cases, you will lose any unused tax breaks.

While April may seem a while away yet, there are just over six weeks left to use your key allowances and exemptions. Making the most of these could reduce the tax you pay, helping you keep more of your hard-earned wealth for yourself and your family.

Read on to discover three important allowances and exemptions you could make the most of before 6 April 2026.

1. The ISA contribution allowance

Individual Savings Accounts (ISAs) are one of the most tax-efficient accounts available for saving and investing in the UK.

Any returns or interest payments you receive within your ISAs are free from Income Tax, Capital Gains Tax (CGT), and Dividend Tax. There’s no tax to pay when you withdraw your funds either. Conversely, you could pay tax on interest or returns from equivalent non-ISA accounts, such as easy access savings accounts.

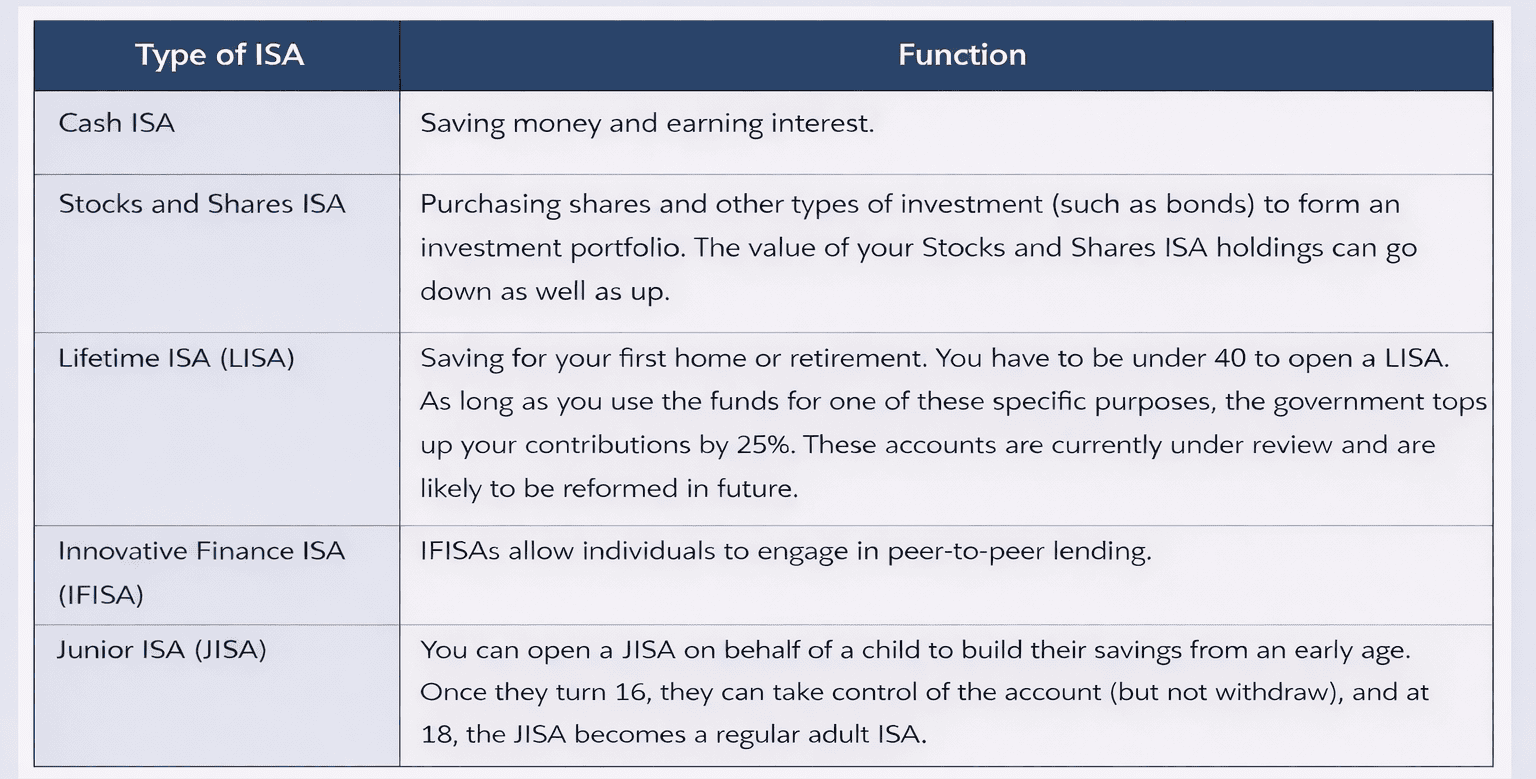

There are five types of ISA to choose from:

Every tax year, your ISA contribution allowance will reset.

Each account has its own stipulations, but there is an overall £20,000 annual contribution limit across your adult ISAs. JISAs have a separate annual limit of £9,000.

These allowances are “use it or lose it” – so if you haven’t maximised your contributions by 6 April, you will lose what’s left of your allowance for the 2025/26 tax year.

Importantly, the rules around how much under-65s can pay into different types of ISAs are set to change in April 2027.

In the 2025 Autumn Budget, Rachel Reeves announced that the amount those under 65 will be able to pay into a Cash ISA will be capped at £12,000 a year, forming part of the overall £20,000 allowance. The government hopes to increase investment within Stocks and Shares ISAs by ringfencing £8,000 specifically for this purpose. Account holders will be able to invest more than £8,000 in their Stocks and Shares ISA if they wish – only Cash ISA contributions will be capped.

As such, it could be wise to make the most of your remaining ISA allowance before it resets on 6 April. With the help of a financial planner, you may then be able to maximise your contributions before the rules change in April 2027.

2. The Capital Gains Tax Annual Exempt Amount

As you may have read in our recent article, CGT receipts are going up. In other words, HMRC is receiving more CGT from taxpayers now than in previous years. With this in mind, it is worth exploring how to pay less CGT if you think you’ll be liable in the coming year.

You will usually pay CGT if you make a profit from selling certain assets, such as:

- Your second home, or a buy-to-let property

- Shares that are not held in an ISA

- Personal belongings worth more than £6,000, apart from your car

- Some business assets.

For example, if you bought a holiday home for £200,000 in 2010 and it’s worth £280,000 today, you could pay CGT on the £80,000 profit, less allowable expenses.

Basic-rate taxpayers pay CGT at 18%, while higher- and additional-rate taxpayers pay 24%.

Every individual has an Annual Exempt Amount of £3,000 a year for CGT. Profits of £3,000 and under remain CGT-free – but the Annual Exempt Amount cannot be rolled over to the next tax year. Spouses and civil partners don’t pay CGT when transferring assets between them, so if you’re married, you could essentially “double” your Annual Exempt Amount.

If you’re planning to offload taxable assets in 2026, you could consider staggering this process so that you benefit from your Annual Exempt Amount “twice” either side of 6 April (as long as you haven’t already used it for the 2025/26 tax year).

A financial planner can help you decide the most tax-efficient way to sell assets.

3. The pension Annual Allowance

In today’s retirement landscape, giving your pension the chance to grow tax-efficiently could be more important than ever.

An October 2025 report from Money Marketing states that while 53% of people are worried they aren’t saving enough for retirement, only 15% say they will prioritise saving into their pensions this year.

The amount you can pay into a personal pension each year without triggering a tax charge is known as the Annual Allowance.

For most earners, it stands at £60,000. There are a few instances where your Annual Allowance could be lower:

- If your adjusted net income is more than £260,000 a year, or your threshold income is more than £200,000, your Annual Allowance will be tapered down. It can reach a minimum of £10,000.

- If you have already flexibly accessed your pension and triggered the Money Purchase Annual Allowance (MPAA), this will reduce your Annual Allowance to £10,000.

Fortunately, you can carry forward any unused Annual Allowance for the three previous tax years, providing the MPAA has not already been triggered. You can also typically claim tax relief on your pension contributions at your marginal rate of Income Tax, giving your pension a further tax-efficient boost.

As April approaches, it may be worth reviewing your pension contributions and, if it fits into your wider financial plan, allocating funds to your pension before the tax year ends.

Doing this now could help you meet your retirement goals more easily. Indeed, even a small additional contribution each tax year, within your Annual Allowance, could compound significantly over time.

Talk to us about adjusting your pension contributions to make the most of your tax-efficient Annual Allowance.

There are plenty more tax breaks to use before 6 April

The above are just three available exemptions and allowances you could make the most of before the end of this tax year.

You could also explore gifting exemptions to help reduce the value of your estate for Inheritance Tax purposes. If you have the opportunity to take dividends from a business, you may wish to utilise the available Dividend Allowance before it’s too late.

Our team can help you maximise tax efficiency before this tax year ends and ensure you remain ahead of the curve in future financial years.

Get in touch

Please get in touch to find out how our team of VouchedFor Top Rated planners could help you plan for the end of the tax year.

Please note

This article is for general information only and does not constitute advice. The information is aimed at individuals only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation, and regulation, which are subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee