When you consider your financial aims, you likely have many personal goals you’d like to achieve. However, you might also consider your children or grandchildren, and how you can use your wealth to support them.

This is a priority for many as the Independent reports that UK parents have an average of £4,001 saved for each child. Additionally, research suggests parents who are actively saving could have an estimated £13,500 set aside by the time their child reaches 18.

However, the research also found that only 20% of parents are planning to look for a new children’s savings account in the current tax year, and 25% are confused about the different choices on offer.

If you fall into this category, you might be missing opportunities to grow wealth for your children. You could also be paying more tax than you need to on interest you generate.

Fortunately, if you take the time to explore different options, you may be able to find a more suitable savings account for your children or grandchildren.

Read on to learn three key factors to consider.

1. The interest rates and fees on different accounts

When choosing a savings account, you may want to start by comparing the interest rates and fees. If you can find an account with a higher interest rate, you may be able to generate greater growth on your child’s cash savings.

This is especially true as interest rates have risen considerably over the last few years. Indeed, according to money.co.uk, the average interest rate on a junior fixed-rate savings account increased from 1.24% in January 2022 to 4.21% by October 2023.

As such, if you opened a savings account for your child several years ago, the interest rate may be much lower than current market rates.

It’s also worth noting that the Bank of England (BoE) cut the base rate – the interest rate it offers to other financial institutions – from 5.25% to 5% on 1 August 2024. The BoE may cut the base rate further in the future.

As a result, providers could reduce their interest rates too, so you may want to compare child savings accounts now and potentially move wealth into an account with a more favourable rate. If you’re able to find a fixed-rate account, you could benefit from higher growth for longer, even if average interest rates fall soon.

As well as comparing the interest rates, you may need to check for fees. For example, many fixed-term accounts might charge a fee for early withdrawals. It’s important to factor these additional costs in when making your decision.

Some accounts may have certain opening requirements too. For instance, there may be restrictions on the age of the child who can use the account. Additionally, some providers may limit the amount of wealth you can earn interest on.

That’s why it’s important to read the small print before opening a new account so you fully understand any restrictions or fees.

2. The tax implications of saving for your child or grandchild

If you’re saving for your children, you might need to consider the tax you’re likely to pay on any interest you generate on that wealth. You may not realise that if your child earns more than £100 in interest on savings you set aside for them as a parent, that interest could be liable to tax as if it belonged to you.

Consequently, any interest that exceeds your “Personal Savings Allowance” (PSA) will be taxed at your marginal rate of Income Tax.

In the 2024/25 tax year, your PSA is:

- £1,000 if you’re a basic-rate taxpayer

- £500 if you’re a higher-rate taxpayer

- £0 if you’re an additional-rate taxpayer.

As such, if you’re earning interest on your own savings, as well as savings for your children, you could quite easily exceed your PSA and pay tax.

Fortunately, there are several ways to mitigate this.

First, the interest does not attract tax if a grandparent pays into the savings account, rather than a parent.

Also, there is no Income Tax, Capital Gains Tax (CGT), or Dividend Tax to pay on growth or interest generated from wealth in a Junior ISA (JISA). You can contribute up to £9,000 a year (in 2024/25) to a JISA, and each child has their own allowance.

So, you may benefit from contributing to a JISA and using up your child’s allowance before saving elsewhere, potentially mitigating tax.

3. How you want to hold wealth for your child or grandchild

You might be saving for your children or grandchildren so you can give them a head start in life and perhaps help them reach certain milestones, such as purchasing their first home or getting married.

The more growth you can achieve, the easier it could be for your loved ones to attain these goals when they eventually access the savings. That’s why you may want to consider how you hold the wealth.

For instance, you could pay into a cash savings account, but you might also decide to invest on behalf of your child or grandchild using a Stocks and Shares JISA.

While investing typically means that you adopt more risk, it might also mean you can generate more growth in the long term. This is thanks to the “compounding effect”, allowing you to generate growth on your original investment as well as previous returns. Over time, compounding can be very powerful and may produce significant growth.

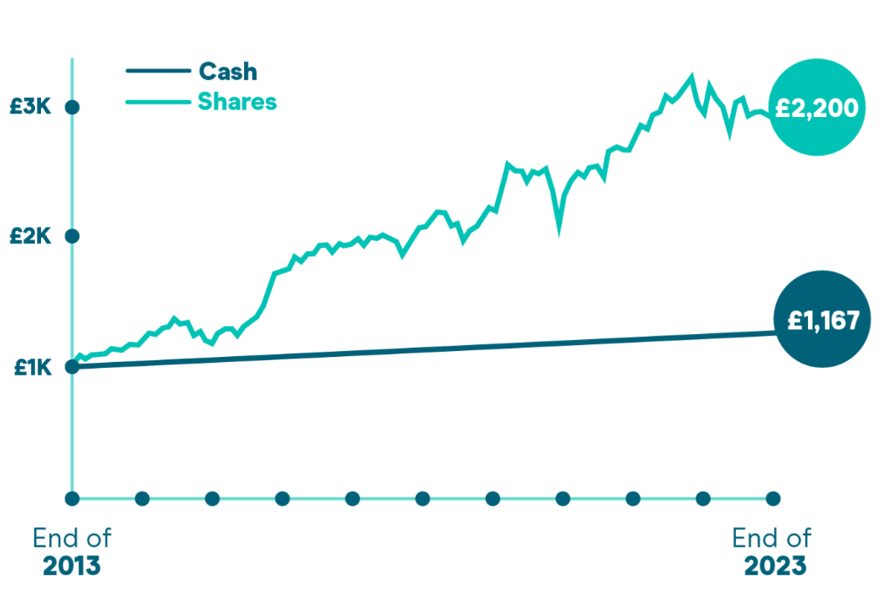

The following graph demonstrates the potential difference between returns from cash savings and investments over a 10-year period.

Source: Moneybox

This assumes that you benefit from the best available interest rate at the beginning of each year. Investments are in a balanced fund and the figures also account for any fees.

Naturally, past performance doesn’t guarantee future returns and investments could lose value. However, as the graph demonstrates, you may see greater growth if you invest instead of contributing to a cash savings account, even when you benefit from the most favourable interest rates.

You may want to consider this if you’re building wealth for a child or grandchild when they’re still young, meaning the savings are likely to be invested for 10 years or more.

Get in touch

If you want to explore potential ways to build wealth for your children and grandchildren, we can support you.

Please get in touch to find out how our team of VouchedFor Top Rated planners could help today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee