The ISA is an incredibly effective tax wrapper that allows you to build cash savings or invest in the stock market.

Each year, you can contribute a total of £20,000 across all your ISAs and enjoy interest or investment growth without paying Income Tax, Dividend Tax, or Capital Gains Tax (CGT) on your wealth.

In a climate of rising taxes and frozen thresholds, it’s more important than ever to take advantage of ISAs, and the statistics suggest that more people are doing so. Unfortunately, many savers may be focusing too heavily on cash and neglecting the benefits of investing.

Read on to learn more.

Savers put a record £103 billion into ISAs in 2023/24

Figures reported by the Guardian show that savers opened 15 million ISAs in 2023/24 – the highest level in 13 years.

The total contributions across all types of ISAs reached £103 billion.

However, if you dig deeper into the statistics, it appears that this rush to contribute more to ISAs was weighted towards Cash ISAs instead of Stocks and Shares ISAs.

The number of Cash ISAs opened increased by 2.1 million compared with the year before, and the total amount saved in this type of ISA rose by 67%.

This increase may have been driven by speculation that the government would reduce the Cash ISA limit, prompting savers to act while they could. Also, interest rates have risen in the past few years, but fallen again recently. As such, savers might want to benefit from these higher interest rates before they fall further.

In this situation, it might seem reasonable to focus on using your Cash ISA. However, holding too much cash could limit your ability to build wealth for the future.

Inflation was higher than the average variable Cash ISA interest rate 85% of the time in the past 5 years

When you place wealth in a Cash ISA and generate interest, it might appear that your savings are growing steadily. However, you may not be seeing as much growth as you thought – or any at all – because of inflation.

Instead of only considering the nominal value of your savings, it’s important to consider what your money can actually buy. If you’re able to buy more goods and services than you could in the past, your wealth is growing.

This all depends on inflation and whether it is higher than the interest on your cash savings.

For example, if you put £10,000 in a Cash ISA with an interest rate of 3% a year ago, you’d have £10,300.

But if inflation is 5%, the same goods and services that cost £10,000 a year ago would now cost £10,500. This means that, despite the interest you earned, your savings have fallen in value in real terms.

According to Finder, over the past five years, the rate of inflation has been higher than the average variable Cash ISA rate 85% of the time. Consequently, if you leave a significant portion of your wealth in cash, inflation is likely eroding your savings.

In fact, Finder’s research revealed that the average UK savings account lost £2,989 in real terms between June 2020 and June 2025.

If you rely too heavily on cash savings and face the same challenges with inflation, you may struggle to achieve the necessary growth to reach your long-term financial goals.

9 in 10 ISA millionaires exclusively used a Stocks and Shares ISA to invest their wealth

A Cash ISA may be attractive because you earn regular interest without exposing yourself to the risks of the stock market, as you would if you invested. However, as we’ve seen, inflation could hamper growth, and your savings may even be losing value.

In comparison, investments in a Stocks and Shares ISA could deliver inflation-beating returns, meaning you’re more likely to reach your savings targets.

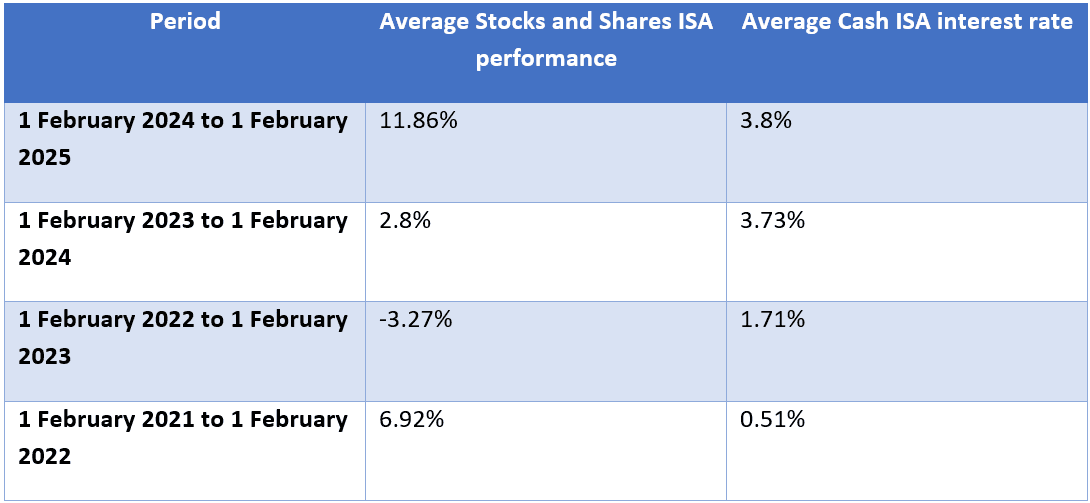

The following table compares Cash ISA interest rates with growth from a Stocks and Shares ISA in recent years.

Source: Moneyfacts

As you can see, the performance of a Stocks and Shares ISA varies, and in some years, you may even experience losses. However, in other years, you may see significant growth which outstrips Cash ISA interest rates and inflation.

Consequently, you may be more likely to build wealth effectively if you invest instead of keeping large amounts of cash.

This is why Financial Planning Today reports that 9 out of 10 savers who had at least £1 million in their ISAs in 2021/22 invested exclusively through a Stocks and Shares ISA, rather than holding cash.

While you may not reach this significant milestone, the figures do demonstrate how investing could be more beneficial than cash.

Get in touch

We can help you make the most of your ISAs.

Please get in touch to find out how our team of VouchedFor Top Rated planners could help today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee