American author Mark Twain is perhaps best known for writing The Adventures of Huckleberry Finn. However, his lesser-known novel, Pudd’nhead Wilson was the inspiration for a common investing myth known as the “Mark Twain effect”.

In the novel, the titular character says:

“October. This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.”

While Mark Twain wrote this as a humorous line, investors have since used the authors name to describe a very real belief that stock markets typically underperform in October. If you’ve heard about this effect before, you might change your investing behaviour as a result. You may even consider cashing out investments before October to avoid any potential losses.

But before you make any changes to your investment strategy, you may want to consider whether the “Mark Twain effect” is a real phenomenon.

October has seen significant market crashes, but overall growth isn’t necessarily lower than other months

The main reason that belief in the Mark Twain effect – sometimes known as the “October effect” – took hold is that several significant market crashes throughout history happened in the 10th month of the year. This includes:

- The Panic of 1907

- The Wall Street crash of 1929

- Black Monday in 1987

- The 2008 financial crisis.

As a result, many investors buy into the idea that stock markets are more likely to fall in October. However, historical data shows that this isn’t necessarily the case.

According to Forbes, since 1928, the S&P 500 has increased in value in October more times than it has fallen. Additionally, averaging out the performance of the index in October over the past 96 years shows a slight gain.

As such, it appears that the Mark Twain effect is a myth, and October may not be as dangerous as you think for investors.

Unfortunately, if you were to panic and sell investments before October because of concerns about an impending market downturn, you could miss out on potential future returns.

The Mark Twain effect is just one common misconception that could affect your ability to invest successfully. Here are three more investing myths to watch out for.

1. The September effect

October isn’t the only month that raises concerns for investors. You might also have heard of the “September effect” – the belief that September is always a poor month for stock performance.

It’s believed that this happens because many people are on holiday over the summer and want to lock in returns in September when they come back. As a result, after a period of low activity over the summer, many investors could sell shares, causing prices to fall.

According to Investopedia, the S&P 500 did in fact average a decline in September between 1928 and 2023. This might lead you to believe that the September effect is a more reliable indicator of market movements than the Mark Twain effect.

Yet, this average fall is measured over almost 100 years and Investopedia reports that, in many of those years, September was far from the worst-performing month. Indeed, in certain years, September saw some of the best returns.

As such, if you sell investments simply because you’re worried about the September effect, you might miss out on potential returns if the expected market dip doesn’t happen. It’s also worth remembering that past performance doesn’t necessarily dictate future trends.

Additionally, the markets may well recover and your investments could continue growing, even if September does bring a period of volatility.

So, while September could be an anomaly where market movements are concerned, it might not be sensible to adjust your investment strategy based on this phenomenon. Instead, you may want to focus on your own personal goals and hold investments in the long term, so you can ride out periods of volatility.

2. Timing the market is the secret to success

Investors may be concerned about phenomena such as the Mark Twain effect or the September effect because they’re attempting to buy and sell shares at the “right” time. There is a common misconception that you should attempt to time the market by purchasing investments when they’re cheap, and then make a profit by selling them when the value increases.

While this might work for a lucky minority, nobody can predict market movements with complete accuracy. As such, you might purchase shares when you think they’re at their lowest price, only to find that the value falls further. You also risk selling investments prematurely and missing out on potential growth in the future.

You might have more success if you take a long-term approach to investing. This is because, despite short-term fluctuations, markets typically grow over time.

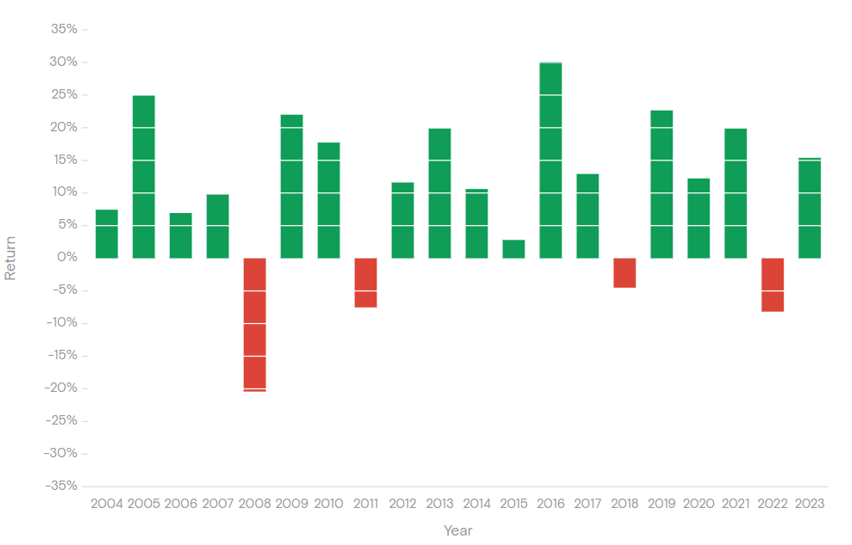

The following chart shows the annual return of the FTSE All-World Index – an index comprised of companies from developed and emerging markets around the globe – over the past 20 years.

Source: Curvo

As you can see, in 2008, 2011, 2018, and 2022, you would have seen losses if you were invested in the companies listed on the index. Yet, in all other years, you would have generated positive returns.

In fact, Curvo reports that between September 2003 and June 2024, the compound annual growth rate of the FTSE All-World index was 10.12%.

If you attempted to time the market and sell investments to avoid losses in certain years, you might have missed out on this growth. However, if you simply left your investments and gave them time to recover from periods of volatility, you would have seen your investment pot expand.

3. It’s easy to invest successfully these days

In the past decade, investing apps have become more prevalent and we all have access to a wealth of information about stock markets online. Unfortunately, this has given rise to the myth that it’s easy to invest successfully these days.

While purchasing investments is simpler than ever, and you can find countless websites or social media profiles offering guidance, that doesn’t mean everybody can invest successfully.

This is because much of the information you see online could come from unqualified individuals or might not align with your own financial plan. Some investment tips could also be scams. So, even if you believe you’ve done your research, you might not be making sensible investment decisions.

Creating a successful investment portfolio requires you to understand your goals and attitude to risk. You also need to know which investment types are best suited to your unique aims, and how to create a well-diversified portfolio to manage risk.

Any mistakes could affect the level of growth you achieve and, in some cases, might lead to significant losses. Conversely, if you seek professional advice, we can help you build a well-balanced portfolio that is suitable for your specific financial plan.

Additionally, we can offer reassurance and guidance during periods of volatility, so you can continue working towards your goals, despite any short-term disruption to your investment portfolio.

Get in touch

If you need support with managing your investments, we are here to help.

Please get in touch to find out how our team of VouchedFor Top Rated planners could help today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Investment

Investment Trustee

Trustee