Your health is a priority as you get older and it’s important to consider this when building your financial plan. In the UK, we are lucky to benefit from free healthcare on the NHS, but as you may know, the institution is facing challenges, particularly when it comes to waiting lists.

Figures from the NHS show that the waiting list in September 2025 was 7.39 million. It’s important to note that this is 230,000 lower than July 2024, but the health service is still facing record demand this winter.

As such, despite government investment and gradual improvements to the waiting lists, you could still face a significant delay in receiving important treatment.

That’s why many individuals are turning to private healthcare.

Read on to learn more.

14% of UK adults had private medical insurance in 2024

As the NHS faces ongoing pressures and waiting lists remain high, many UK adults are opting for private medical insurance (PMI), so they have easier access to vital treatment.

According to the Actuary, 14% of UK adults – 7.6 million people – had PMI in 2024. This is a significant increase from 6.7 million in 2020.

People in the middle of their careers are the most likely to take out PMI, with 18% of 35- to 44-year-olds and 19% of 45- to 54-year-olds having a policy of some kind.

This may be because many employers offer PMI as a benefit. However, whether you’re part way through your working life or in retirement, taking out your own PMI policy could help you stay healthy for longer.

Private medical services could improve your health but can be very expensive

If you wait a long time to see a GP on the NHS, routine problems could become worse and serious issues might go undiagnosed for longer. Additionally, long waitlists for treatments may mean you live with painful and limiting health conditions for an extended period, affecting your quality of life.

However, if you use private medical services, you could be seen faster and potentially catch health issues earlier. You’ll also receive treatment sooner, meaning you can get back to enjoying your life.

That said, private treatments can be costly.

For example, Circle Health Group reports that the average cost of a hip replacement surgery in the UK is around £14,500.

Meanwhile, for a GP appointment, Bupa charges:

- £79 for 15 minutes

- £140 for 30 minutes

- £200 for 45 minutes

- £250 for an hour.

These are significant expenses and as you age, you may be more likely to have regular health issues. If you’re paying for private care as and when you need it, the costs could quickly add up.

If you have to find funds for expensive treatments during your retirement, you could quickly deplete your savings, affecting your quality of life in the future.

Insurance could make the cost of private medical treatments more manageable

You may be unsure about taking on the added monthly cost of PMI premiums at a time when living costs are rising.

However, you may not be able to avoid health issues, especially as you get older. If you want to reap the benefits of private healthcare, insurance might be a more sustainable way to manage the cost.

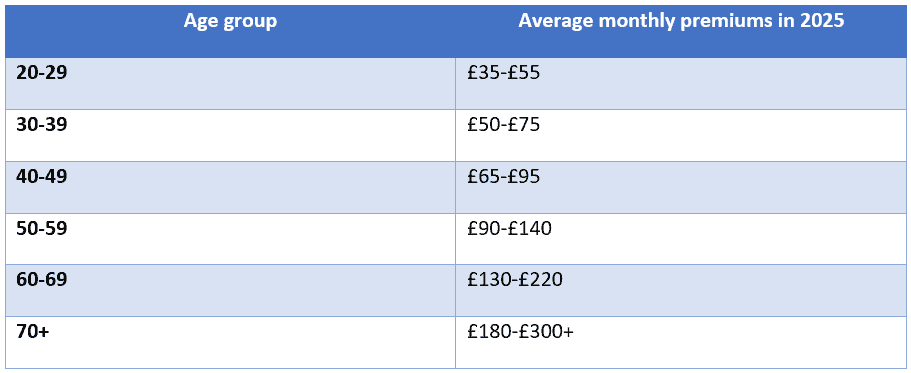

The price depends on several factors, including your age and current health status. The following table shows how much you could pay each month for health insurance in 2025.

Source: WeCovr

These figures are based on a mid-level policy with a £250 excess.

As you can see, the cost increases markedly as you get older because you’re more likely to make a claim.

Despite this, the monthly premium for insurance may still be more affordable than paying a lump sum for treatment. You can factor the payments into your budget and spread the expense, rather than potentially having to find tens of thousands of pounds at short notice.

Paying the monthly premiums also gives you peace of mind knowing that you have access to private medical services whenever you need them.

We can help you decide whether private medical insurance is right for you

As private medical insurance becomes more popular, we can help you factor cover into your financial plan.

We can review your budget and determine whether you can absorb the monthly premiums for PMI and what level of cover you can comfortably afford.

Additionally, we can review your savings and see whether you could pay for treatments out of your own pocket without insurance. More importantly, we can use cashflow planning to model the effect that such a large outlay would have on your overall financial position.

Using this information, you can decide if PMI is the right choice for you.

Get in touch

We will support you in finding the best ways to protect your health.

Please get in touch to find out how our team of VouchedFor Top Rated planners could help today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The Financial Conduct Authority does not regulate cashflow planning.

Note that financial protection plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.

Investment

Investment Trustee

Trustee