Christmas is a time for giving, and you might be thinking about the presents you are going to pass to your family and friends.

A cash gift may be a great option as the additional funds could help your loved ones work towards their own goals. What’s more, gifting cash this Christmas may help you reduce the Inheritance Tax (IHT) that your beneficiaries pay after you’re gone.

This might be more important than ever because, as you recently learned in our Budget update, chancellor Rachel Reeves changed certain IHT exemptions. For instance, from April 2027 onwards, pensions will no longer fall outside your estate for IHT purposes, meaning families could pay more IHT in future.

Fortunately, if you take advantage of gifting rules this Christmas, you could potentially mitigate a large IHT bill.

Read on to learn how.

Between them, a couple can now pass on up to £1 million without paying Inheritance Tax

When you pass away, your beneficiaries may pay 40% Inheritance Tax on any portion of your estate that exceeds a threshold known as the “nil-rate band”.

In 2024/25, the nil-rate band is £325,000. You may also benefit from an additional £175,000 “residence nil-rate band” when passing your main home to a direct descendant such as a child or grandchild.

Crucially, you can pass your entire estate to your spouse or civil partner without IHT being due, and they inherit your unused nil-rate bands. As a result, you may be able to pass on up to £1 million between you.

Despite this, your family could be more likely to pay IHT than you realise because the nil-rate band has been frozen since 2009 and the residence nil-rate band since 2020. In her Budget, the chancellor recently confirmed they would remain so until 2030.

Yet, since 2021, house prices have risen and could continue to do so in the future. The value of your savings and investments may increase too, and your pensions will no longer be exempt from IHT after April 2027.

As such, a larger portion of your estate could exceed the nil-rate bands, meaning that your family pays more IHT. It’s important to keep this in mind as you get older – and luckily, you might be able to mitigate a large bill if you get into the spirit of giving this Christmas.

You could take advantage of “the 7-year rule” to pass more wealth to your loved ones tax-efficiently

Gifting wealth during your lifetime could be an effective way to reduce the IHT that your family pays in the future.

The first £3,000 you gift each year automatically falls outside your estate for IHT purposes – this is known as your “annual exemption”. Under these rules, you can also gift £5,000 to a child and £2,500 to a grandchild for their wedding.

Any further gifts you make may also fall outside your estate, provided you live for seven years after transferring the wealth. This is known as the “seven-year rule”.

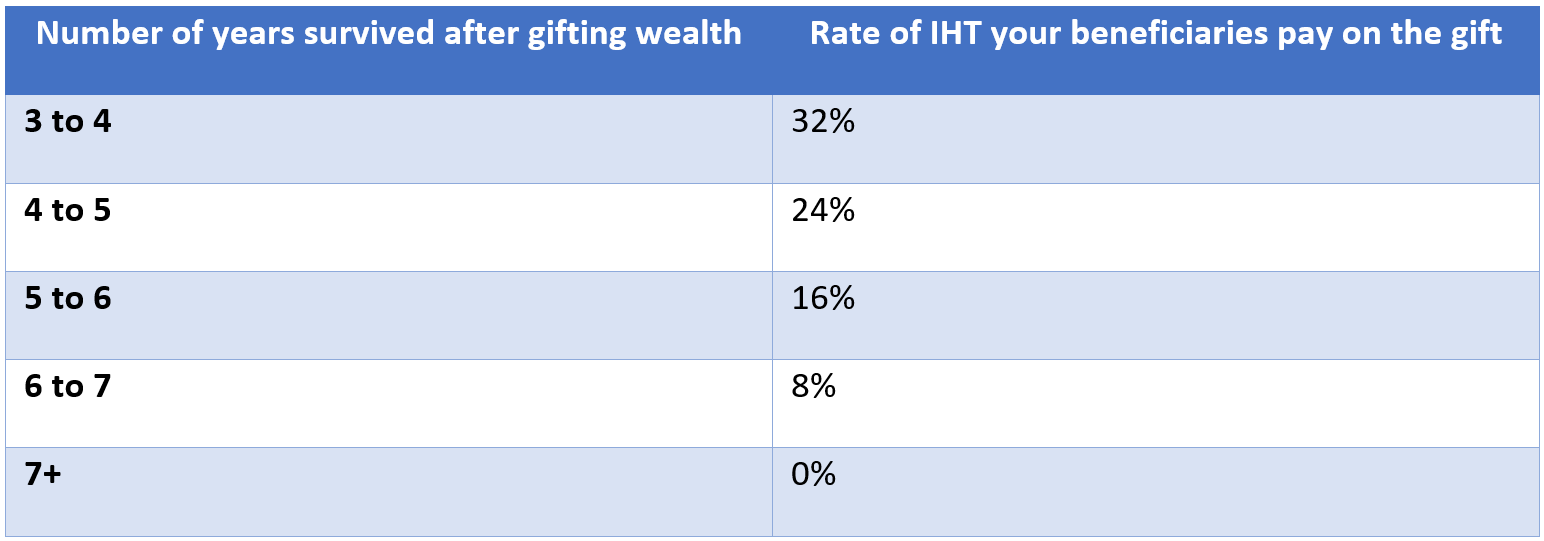

If you survive for longer than three years but less than seven, your family may pay some IHT on the taxable sum, and this is calculated based on a sliding scale known as “taper relief”.

Source: UK government

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

You may also be able to make regular payments to loved ones using the “gifts from income” rule. Learn more about this in our previous article on how using the gifts from income rule could help you mitigate IHT in the future.

Using these gifting exemptions to pass wealth to your loved ones this Christmas could help you mitigate a large IHT bill.

Supporting charities at Christmas could also help you reduce the tax your family pays in the future

As well as giving gifts to your family, you might want to support causes close to your heart during the festive period. Many charities are especially grateful for your donations around Christmas, and the payments could help you reduce your IHT liability too.

This is because any charitable donations are automatically exempt from IHT, no matter how large.

More importantly, if you leave at least 10% of your estate to charity, your family may pay IHT on the remaining taxable estate at a rate of 36% instead of 40%.

To benefit from this exemption, you can make donations while you’re alive, leave a portion of your estate to a charity in your will, or both.

However, if your donation is large enough that it exceeds the amount your family saves from the reduction in the rate of IHT, they could receive a lower inheritance as a result.

That’s why you may want to seek professional advice to find the most tax-efficient ways to gift wealth.

Get in touch

If you’re planning on gifting wealth to your loved ones this Christmas, we can help you take advantage of the tax benefits.

Please get in touch to find out how our team of VouchedFor Top Rated planners could help today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning, tax planning, or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Investment

Investment Trustee

Trustee